Buyer intent data is great. But what do you do with it?

In the world of B2B, only about 5% of your target market is in the mood to buy at any given moment. Figuring out which 5% is a difficult question, but the answer can be revealed by the use of intent data.

Intent data (or buyer intent data) is the use of web analytics to determine whether or not a given user or company is showing strong, purchasing interest in you or your competitors. Its emergence in the past few years have taken the world of online sales and marketing by storm, and for good reason.

As we leave behind the golden era of ZIRP, we are all tasked with doing more with less as budgets tighten while sales targets are raised. Chasing the wrong targets then becomes a superfluous exercise and a massive waste of time and money, hence intent data comes into play to separate the wheat from the chaff.

But while there is now an abundance of intent data sources available, companies still struggle to make use of it effectively and efficiently. Change is hard, and the opportunity of using intent data frequently arises when companies decide on pursuing an account based marketing approach, which means scrapping the old playbooks and adopting new processes, tools and a frame of mind.

In this article, we’ll help you navigate the intent data landscape and guide you through the pitfalls when it comes to successfully implementing it in your go to market strategy.

Who’s showing interest?

The traditional approach for sales and marketing would be to look at the buyer’s journey as if it were a funnel. In this view, your potential customers are people with specific problems who you educate first and convert later by convincing them that your solution is in fact the best.

This is not bad, it just happens to by myopic. Ultimately, it’s a self-centered worldview that doesn’t account for the reality of your customers.

We’re all busy people working primarily towards the goals of our companies. To achieve those goals, we do a lot of research on what are the best solutions or processes to help us. We work with people across departments, argue for more budgets or have our priorities changed abruptly all the time.

And at the end of the day we buy software to get a job done, and we get a job done because we want to hit our goals, and we want to hit our goals because we want to advance in our careers, etc.

That’s a more complex reality than merrily sliding down a funnel of awareness!

In fact, the following are disregarded by the funnel approach:

- Buyers are not individuals or companies, but committees,

- Our ICPs spend most of their time out of market when they don’t want to buy at all,

- By the time they want to buy, they’ve already done 80-90% of the research,

- There’s all sorts of stuff constantly happening within their organization that lead to state changes which make decisions either urgent or completely sideline them.

Or in other words, the buyer lives in their own world and that’s the reality you have to deal with: you either catch them at the right time, or they’ll go and sign up with your competitor.

Ultimately, intent data is about figuring out when a lead is the most interested. It relies primarily on engagement metrics, whether it’s a user reading your pricing page, looking at your G2 reviews or researching your software space. It’s about tracking activity that a buyer would exhibit when they are in-market.

There are three sources (or categories) of intent data.

First party intent data

This is information you collect about your prospects directly. In the classical sense, think of metrics such as form fills, downloads, chats or email based inquiries. PLG driven companies can also track product usage metrics and milestones.

But it can also mean engagement with your content.

A recent HockeyStack research piece showed that prospects read over 4 blog posts by at least two different users before becoming marketing qualified leads, which indicates a buyer committee snooping around in the research phase.

Second party intent data

Part and parcel of the software buying research process is looking at review sites like G2 or Gartner. Their entire pile of user analytics is a big wonderful heap of intent data, and they are more than happy to sell it to you for a price.

This comes into play not only when someone’s looking at your company profile, but also if a prospect or existing customer is eyeing down the competition - presenting excellent/urgent opportunities to reach out to them.

Third-party intent data

These are delivered by data brokers who collect intent data from various sources. Players like Bombora, Snitcher, 6sense, Foundry and the like rely on all sorts of black magic to reveal which buyers are in your market even before they’ve hit your website.

In short, you have plenty of options to get purchase intent information. The question is: what do you do with it?

Capitalizing on intent data

Gathering intent data is only the first step of the process. In the words of Infinityn CEO Robert Bukits:

Intent is a starting point: identifying intent signals from potential buyers is like finding the North Star. It sets a direction, but it won’t get you to your destination. Intent data reveals who’s showing interest, but it doesn’t tell you the whole story.

Beyond intent: account and buyer persona research: Imagine embarking on a journey without a map. Intent data is your compass, but you need more. Account-based research and understanding buyer personas are essential. Dive deep into your target accounts. Uncover pain points, challenges, and aspirations. This knowledge sharpens your aim.

It gives you the go signal to spring to action, but you still have to figure out who to contact - and how.

Resolving visitor identities to the company level is a pretty much solved problem with 3rd party data with around 80% accuracy in the US and 50% in the EU.

But a company is not a person and personal level resolution is only 30% accurate in the states, and virtually non-existent in the EU due to GDPR.

At this point, you have two options:

Finding their internal ICPs

Once you have a company level target who’s shown intent, you can use tools like Clay and Apollo to find out who’s the closest match to your ICP at the organization.

Remember that on the other end of the screen is a person who’s trying to do their job and is doing research around solutions. More likely than not, they are chatting about the space with their coworkers or bosses (the decision makers), ie. they should look like your ICP!

Once you’ve figured out who they are, it’s a matter of your reach out cadence: adding them on LinkedIn, sending them emails or even calling them on the phone are options. These days, much of this can be automated, which is good because you want to be as fast as possible: they might not be in the market for long.

Live Video Calling

The second option is using Captiwate to start a video call with them while they are still on your site.

Obviously, you wouldn’t want to randomly dial everyone. But you would want to grab the attention of someone who’s showing purchasing intent (say, by looking at your product or pricing pages) or a key target account.

What’s more, you have to do this as soon as possible. Austin Hughes, founder of Unify GTM said that the window of opportunity for contacting someone who shows intent is less than 15 minutes!

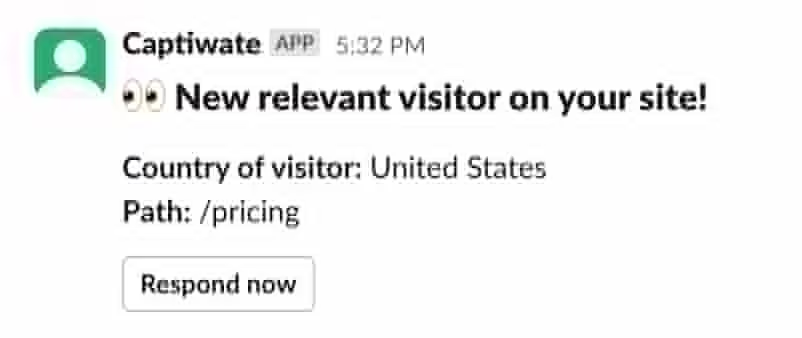

This is why Captiwate allows you to set up alerts which notify you on Slack if a VIP is showing intent while they’re on your website:

Live video calls also have distinct advantages over other forms of contact.

- They are more personal. We don’t buy from companies but from people we trust, and a live video call is the best way to establish that (if meeting them live is not an option). This is doubly so in the age of rampant ChatGPT based outreach.

- They are fast. As we’ve covered in our previous post on lead response times, contact in the first hour - or better yet, the very minute they are showing interest can make or break a deal.

If you’re curious about this approach, feel free to book a demo: we’d love to show you around.

Concluding thoughts

Buyer intent data has quickly become one of the most reliable tools of sales and GTM teams looking to increase their pipelines and closing more deals. But purchase intent in and on itself is not enough: it’s merely a strong signal for your team to engage with a prospect.

Ultimately, it comes down to how well you personalize your approach and how you conduct your follow up that matters.

Remember, it’s not how you want to sell but how buyers want to buy, and intent data plays a crucial role in figuring out who’s in the market - or in other words, who to focus on.